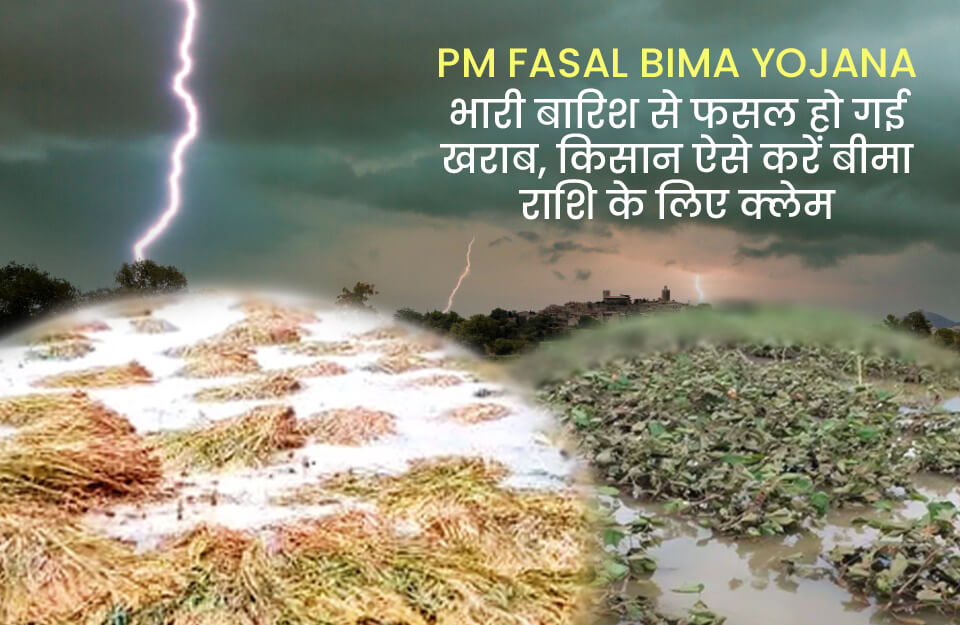

New Delhi, Central Government: Heavy rainfall occurring in many states of the country for the past several days has brought great devastation for the farmers. Most of the standing crops have been damaged due to heavy rain and storms, causing significant losses to the farmers. In Uttar Pradesh, due to heavy rainfall in the past four days, crops such as rice, bananas, mustard, cauliflower, spinach, and coriander in several districts of the state have been completely destroyed. Thousands of acres of standing crops have been ruined due to heavy rain and floods. This has led to immense despair among farmers across the country. In fact, while some farmers had taken loans to sow their crops, others had expected to meet various major expenses such as children's weddings, education, and other significant costs from the income generated from their crops. In many places, farmers are demanding appropriate compensation from the government. In this regard, khetivyapar.com is informing the farmers who are facing difficulties about how they can claim compensation for their losses after the destruction of their crops.

Learn about the Prime Minister Crop Insurance Scheme (PM Fasal Bima Yojana) In view of the problem of crop losses faced by farmers, the Government of India has introduced the Prime Minister Crop Insurance Scheme (PM Fasal Bima Yojana), under which farmers can insure their crops by paying a nominal amount. If the insured crops are damaged, the insurance company compensates the farmers for their losses. However, it depends on the farmer whether they want to insure their crops or not. Most farmers do insure their crops.

How to get insurance? It is quite easy to get crop insurance under the PM Kisan Fasal Bima Yojana. Farmers who have a Kisan Credit Card or any other agricultural loan can get their crop insured from the same bank. They just need to fill out a form at the bank. The bank requires the farmer's land and other documents, which makes the insurance process easy. Moreover, those farmers who do not have a loan can also get insurance from any bank. The government has authorized one or more insurance companies in each district to provide crop insurance, and the banks stay in touch with them. Farmers can get their crop insured by taking their Aadhaar card, land-related documents, details of the crop sown in the field obtained from the revenue officer, and an ID card such as a voter card to the bank.

How to claim? Under the PM Fasal Bima Yojana, insurance claims are provided in two ways: first, in case of crop damage due to natural calamities, and second, in case of crop failure based on average. If the crop is destroyed due to a natural calamity, the farmer must inform the agriculture department about the crop damage within 72 hours and fill out a form. The form should provide information about the reason for crop damage, the type of crop sown, and the area of land where the crop was sown. It should also include details about the village where the field is located, land-related information, and so on. Along with this form, a photocopy of the crop insurance policy is also required. The bank from where the insurance was taken provides the insurance policy. After submitting the application, representatives of the insurance company and the agriculture department inspect the field and assess the damage. Based on this assessment, the insurance amount is determined. After some time, the insurance amount is deposited into the farmer's account. How much claim is received? Under the Prime Minister Crop Insurance Scheme (PM Fasal Bima Yojana), the insurance amount varies for different crops. For cotton crops, the maximum claim amount can be ₹36,282, for rice crops, it can be ₹37,484, for millet crops, it can be ₹17,639, for maize crops, it can be ₹18,742, and for mung bean crops, it can be ₹16,497 per acre. Based on the reduced yield, the insurance company automatically deposits the money into the farmer's account. There is no need for the farmer to apply separately for this.w much claim is received?